Illinois Consumers Look For Lower Interest Rates, Credit Building in Personal Loans

A 2021 survey gives alternative lenders and policymakers a glimpse of what borrowers, particularly former predatory loan customers, are looking for in short-term, small-dollar loans.

Blog Post

Oct. 25, 2022

Introduction

Vincent had seen his mother take out payday loans frequently as a child so he was familiar with the process. But when he took out a payday loan, a missed call from a lender and auto payment from the wrong account led to him losing his bank account and paying extra out of each paycheck at a check cashing store. He’s being careful to rebuild his credit but he was set back financially for years. Fortunately, Vincent found a fintech alternative that helps him build credit and take out a no interest loan for just a day or two to pay bills before his check comes, an important option for the many people who need a little money between checks when their bills don’t line up with their pay periods.

While small dollar loans(1) are often described as one-time emergency measures, the majority of these loans are taken out by the same people over and over again, part of an endless cycle of debt. The Consumer Financial Protection Bureau found that more than four out of five payday loans are re-borrowed within a month, and the majority of payday loans are borrowed by consumers who take out at least 10 loans in a row.(2) In Illinois, there were 6.6 predatory loans of different types on average for every borrower between 2012 and 2020.(3)

In April 2021, the State of Illinois enacted the Predatory Loan Prevention Act (PLPA), placing a 36 percent cap on the annual percentage rate (APR) for most consumer loans, including payday, installment payday, and auto title loans, to ensure these loans would be more affordable for consumers. Based on how frequently Illinoisans take out repeat small dollar loans, at the end of 2021 we set out to find out what types of short-term, small dollar loans people are looking for following the passage of the PLPA. In the winter of 2021/2022, as part of our work on the WeProsper Coalition, New America Chicago, Woodstock Institute, and the Chicago Urban League ran a survey of Illinois residents to learn more about what people were looking for in short-term, small dollar loans to help us advocate for new, safer alternatives following the rate cap.

Ultimately, the goal of WeProsper Illinois is to ensure low and moderate income Illinoisans have access to safe, affordable lending products that help them get through tough economic hardships and build economic stability over time. Our survey was one step in the right direction. The survey was supplemented by a second survey in mid 2022 conducted by Woodstock Institute with Lake Research Partners. Answers to these series of surveys will help banks, fintech, credit unions, nonprofit CDFIs, and government policymakers learn more about how to provide safe, affordable alternatives to low and middle income communities in Illinois.

Survey Overview

The 2021/2022 survey was available in both English and Spanish and completed by 119 people, including 12 Spanish speakers. Those surveyed were spread out across Illinois zip codes, with a substantial number in Chicago and the surrounding 7 county area. A few hundred respondents from outside Illinois were dropped from survey results. People who responded were also a variety of ages from 18 to 59, with only 5 percent over the age of 60. In terms of racial and ethnic diversity, almost 4 in 10 were Black, around 3 in 10 were White, and around 2 in 10 were Latinx/Hispanic.

Trusted Sources for Affordable Alternatives

Nonprofits, credit unions, and banks that provide affordable alternatives to predatory loans for low to moderate income populations need to find trusted marketing channels and messengers to get their products out to the public. Online ads, social media, and friends and family referral rewards are likely the best investment to reach potential customers.

Half of all those who responded had taken out a payday or auto title loan in the last two years, or someone in their family had. Among those respondents, online ads or social media were the most common sources for information about loans at 38 percent. People were also more likely to borrow based on a personal referral or their own past experiences. Thirty-one percent had heard about the company or loan from a family member or friend.

“I think the ads are more electronic now. It’s a Dave banking situation or an app. It’s easier to go online. I don’t see the promotion of payday loans in the area I live in now.” - V.J.

Borrowers Deal Breakers and Makers

We asked people what was important in helping them choose where they got loans and what type they received. There were some important common themes in people’s answers. Among survey respondents who had taken out a small loan in the last two years or had tried to take out a loan in the last six months, the top three features were the same. The top features that were most important to people in choosing a loan was that they were easy to repay, had options for when and how to make payments, and guaranteed approval. The following chart includes the top answers for those who had taken out a short-term loan since 2019.

The same features were top three for people who had needed extra cash since April 2021, but the order was different. For this broader group, knowing they would get approved was number one.

Community members wish they could find low interest rates and help building credit

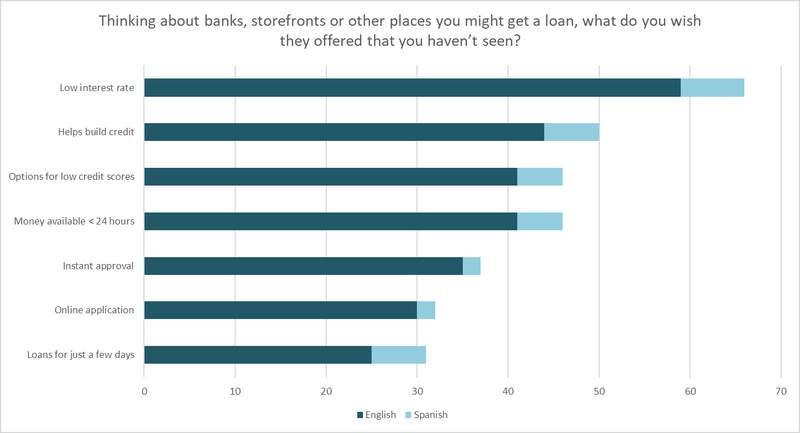

In our survey, we also gave people a chance to say what they weren’t finding in the market at that time. When we asked consumers what they wish they could find in a personal loan, most were looking for low interest rates, followed by a loan that helps build credit. Options for people with low credit scores tied with money that was available within 24 hours for third place. Across all of the different groups we looked at, a low interest rate was the most popular loan feature people wish they could find but hadn’t seen.

“It’d be nice to get a line of credit in a way that would count positively towards your credit score. If you pay it off early you should get rewarded. Something that wouldn’t be a huge amount over time. Small amounts. It could be something that goes back to your credit report.” -C.O.

Surprisingly, the seven options we presented seemed to meet all of people’s needs. When given the option for typing in another loan feature they wish they could find but haven’t seen, no one entered any other suggestions. This is unusual in our surveys.

Desired Loan Features Differ by Population

However, when we look at our results in more detail, it is clear that people’s needs differ slightly based on their specific situations. Because this survey is on the smaller side, we’ve avoided making major claims about differences based on race and ethnicity, income, or age groups. However, there were some interesting differences by race and people’s past experiences with loans and financial situations that are worth noting.

Just over 100 survey respondents included their race on the survey. Because WeProsper focuses on helping Black and Latino/x communities build wealth to reduce the racial and ethnic wealth gap, this analysis focuses on those groups, although other groups’ experiences are also important. For all groups, regardless of race and ethnicity, low interest rates were the number one thing they were looking for in a loan but hadn’t seen (78 percent of Latino/xs and 63 percent of Black respondents).(4)

From there, the results differ slightly and suggest loan features that Latino/a/x and Black residents have not had access to. Options that build credit were particularly sought by Hispanic or Latino/a/x respondents (61 percent). Options for people with low credit came in third for Hispanic or Latino/a/x Illinoisans (48 percent). For Black survey respondents, the results weren’t as definitive suggesting different needs or access to different types of loans within the group. Options for people with low credit tied with money available in less than 24 hours for second place (47 percent). Coming close behind was a tie for third place among Black survey respondents between helps build credit and instant approval (45 percent).

However, it’s important to note that these results don’t confirm importance but rather loan features people wanted but hadn’t found. Features that were less popular on this question may have already been found by the people who responded. Popular features may not be marketed to that population or may not be offered in neighborhoods where they live.

Payday and Auto Title Loan Customer Needs

Those who had taken out payday or auto title loans over the last two years were still looking for low interest rates and were interested in options that build credit. However, personal loans that are available in less than 24 hours outranked help building credit. This suggests that these individuals may have gone to payday or auto title loans because they had an urgent need in the past, and are still looking for options that can get them needed money fast to pay a bill or emergency expense. Among our small number of Spanish speakers who had taken out a payday loan in the last two years, 24-hour turn-around took the top spot, tying with loans for only a few days. These both were slightly higher than the second place low interest rates.

People with Recent Financial Challenges

Among people who had found that they needed extra cash for an emergency or basic expenses since the law passed in April 2021, we saw a similar pattern. A low interest rate was even more sought after by this group than it was for payday and auto title customers and was a top priority for both English and Spanish speakers. Loans for just a few days were more sought out by Spanish speaking consumers, but tied for second place with helps build credit, options for people with low credit scores, and money available in less than 24 hours.

“Personal loans up to $500 with a flat rate, people would be more likely to use it. Make it a small loan so it’s easier to pay back. And put a limit on how often people can do it. You want to break the cycle. Usually people are paying bills and they need $5,000 or $500 right now.” - S.L.

Recent Potential Borrowers’ Desired Loan Features

Those who had tried to borrow money in the last 6 months were most interested in finding low interest rates. This was particularly important to this group. Building credit and accessing money quickly were also important for this group. A loan that helps build credit came in second followed closely by money being available in less than 24 hours. Options for people with credit issues weren't far behind. Several features tied for the top loan wishlist feature for Spanish speakers who’d recently tried to borrow money, suggesting the group has diverse needs. These included low interest rate, helps build credit, money available in less than 24 hours, and loans for just a few days.

“No interest is good. I’m a new customer of Chime. I think it’s pretty cool. They have something called Spot Me. It’s fee free. It’s a max of $20 right now based on activity. A max of $400 to $500 would be good for low-income people versus a max of $10,000 for middle-class people.” - W.L.

People Who Were Unable to Borrow Money

There were only a small number of English speakers in our survey who were unable to borrow what they needed, just 11 percent. Most were able to borrow all or some of what they needed, and all of the Spanish speakers were able to borrow some or all of what they needed. Because of the small number, these results should not be taken as definitive by any means. However, it’s useful hearing specifically from people who have had trouble borrowing what they couldn’t find but would like to.

Among these respondents, low interest rates were their top desired feature, however other features that were not as popular with other groups also rose to the top. Both low credit and quick access seem to be the major barriers for those who hadn’t been able to borrow what they needed. Three features tied for second place for this group: money available in under 24 hours, which was popular with other groups, but also options for people with low credit scores and instant approval, which weren’t as popular with all the groups. This suggests that these people may not have been able to find what they needed because their credit was low and/or because they found they needed the money very quickly. Loans that help build credit came in third for the small group who had been unable to borrow what they needed recently.

Conclusion

While the PLPA has greatly reduced the cost of borrowing in Illinois, the reality is that 36 percent is still a high annual percentage rate (APR). While their needs vary somewhat across populations, creating new personal loan alternatives with lower APRs that allow people to build their credit, would be helpful to Illinoisans who formerly used predatory loans. Creating options for people with unexpected emergency expenses and options for people with low credit would go a long way to helping communities weather economic hardships, make ends meet and build financial stability over time.

See the most recent 2022 survey results from Woodstock Institute.

Special thanks to Vanessa Rangel, Greg Porter, Spencer Cowan, Kathie Kane-Willis, and Naomi Johnson for all their hard work on this survey.

(1) Short-term, small-dollar loans include payday, installment payday, auto title, and pawn loans. For this piece, we use the term to refer to personal loans under $5,000.

(2) CFPB Finds Four Out Of Five Payday Loans Are Rolled Over Or Renewed | Consumer Financial Protection Bureau. Consumer Financial Protection Bureau. 2014.

(3) “Illinois Trends Report: Select Consumer Loan Products Through 2020” Illinois Department of Financial and Professional Regulation. 2021.

(4) In the survey, Hispanic or Latino/a/x includes different racial backgrounds, e.g. White, Black, Native American/ Indigenous or multiracial.