Earned but Unclaimed: Making Illinois Tax Refunds Work for the Families Who Need Them

Blog Post

Fly View Productions via Getty Images

Aug. 12, 2025

Noemi and her husband work hard. She spends her days caring full-time for their two grandchildren, unpaid but essential work; he’s an independent carpenter. Evenings are a bustle of activity with their adult children coming home from jobs and school. Noemi also volunteers with a local organization helping other women manage their finances. Despite this, our interview is the first time she’s heard of the Illinois Earned Income Tax Credit (EITC), a benefit she and her husband likely qualify for.

Noemi has always filed their taxes using a paid tax preparer to ensure it gets done correctly. But, since losing work in the pandemic, she and her husband haven’t been able to afford filing. Moreover, they’ve taken on debt to cover basics, like food and repairs—debt they’re still working to pay off. “Loan after loan after loan…you start with a little crack and you end up with a huge hole,” she said. Still, she’s hopeful.

“It would be great to get [the EITC] because people would also be able to do the taxes they haven’t been able to do,” she said. Laughing, she added, “No da paso sin huarache,” a Spanish phrase that is the equivalent of catch-22.

Noemi explained, “You can’t file without having the money, and you don’t have the money without filing.” If EITC were easier to access, she’d opt in right away. “I think if you guys say, ‘We want your help sharing this with the community,’ we’ll be ready because it’s really going to help the community.”

Background

In Illinois, thousands of households are unaware that the government owes them money. The Earned Income Tax Credit and Child Tax Credit, benefits delivered through the tax system, have a broad reach but go unclaimed by families working the lowest-paid, but essential jobs.

Across the country, millions of Americans working hard in service, gig, and hourly work struggle to keep up with the rising cost of living. Many are eligible for the Earned Income Tax Credit or Child Tax Credit, but never receive them because they aren’t required to file taxes. This includes those who earn less than $21,900 for a single head of household or $29,200 for a married couple in 2024.

While these individuals are often referred to as nonfilers, our past interviews show the choice of whether to file varies year to year based on the amount or type of income, confusion about how to file, or other considerations. Though some of these households would be above the filing threshold, in Illinois, 21 percent of households earned under $34,999 in 2023. This was nearly identical to the national rate of 22 percent in the same year.

In collaboration with Inclusive Economy Lab (IEL), the team at New America Chicago learned that approximately 54,147 Illinois households enrolled in Medicaid or SNAP are not required to file taxes but earn enough to be eligible for refundable tax credits. IEL estimated that these families miss out on an estimated $24.9 million each year in Illinois EITC payments and many more millions in federal CTC and EITC.

“I didn’t think that I earned enough money, so I did not file taxes. I didn’t have enough information to know that…I was eligible for the Child Tax Credit.”

—Amanda, mother of two

Fear about making mistakes on their tax returns can keep households from filing or cause them to spend substantial amounts of money paying for tax preparation. In past CivicSpace interviews with Illinois parents, our team learned that some families making as little as $6,000 a year were so worried about making errors on their tax forms that they spent as much as $400 dollars to have their taxes prepared by a tax professional.

“It was too many key terms or too many questions I couldn’t answer. What was I actually supposed to put? And it’s like, when was I going to finish it? When was I going to have the time with my busy schedule with the kids?”

—Kellia, describing how challenging tax return forms can be, especially while juggling family demands

In 2020, New America Chicago began piloting ways to close the gap for eligible families—by collaborating with state agencies, advocates, and community members to reduce bureaucracy and simplify access to beneficial tax credits like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC). This effort focused on building support for a simplified, automated filing approach that reduces paperwork for taxpayers, tested in California and New York in the 2000s.

The Illinois Department of Revenue (IDoR) began efforts that year to expand access to tax credits via a simplified filing initiative assisting EITC-eligible residents who file only federal taxes. This initiative alerts residents to money owed to them and allows them to file and claim the Illinois EITC with minimal effort by prepopulating state returns using tax information they have already submitted to tax authorities. This approach gives taxpayers the option to claim funds owed them, if they wish.

In 2024, the team began working with IDoR and the Illinois Department of Human Services (IDHS) to go beyond that initial initiative to assist additional low-income households who were unaware that they were owed money and may not file yearly. We specifically chose to initially focus on individuals with dependent children, because they are eligible for both more tax credits and higher tax credits than those without children in their care. The original goal was to explore ways to expand simplified filing further with IDoR and IDHS in order to further help those doing low-wage and unpaid care work who needed additional assistance to help provide for themselves and their families.

A New Program Draws From Families’ Experiences

It was clear that many families were missing out on tax credits due to two factors: being unaware of their eligibility and the cost barrier when filing. However, if these households have applied for financial help through IDHS, they have already provided detailed income and family information. This raised the question: What if Illinois could save families time and money by using information already shared with state agencies to streamline access to the state EITC and CTC?

Simplifying tax filing for families already connected to IDHS

This opened up an opportunity to explore whether a new program could remove the awareness and cost barriers for eligible families who already share their data with IDHS. Ideally, such a program would allow families to opt in to receive a simplified, pre-filled tax return by sharing the data they spent hours submitting to IDHS with IDoR. Families could then correct, amend, or decide not to file the return. However, the team had already found that the agencies collected similar data differently, requiring a new approach to help reduce steps and paperwork for families, while preserving accuracy in tax accounting.

New America and our partners wanted to ensure the program would fulfill real needs and uphold the highest data privacy standards for participants. For families trying to make ends meet, a program that allowed them to access tax refunds to meet some needs, but caused them to lose precious child care or rental assistance, could push them further into poverty. Families need to be able to make informed decisions about whether any new program would help them cover their core expenses or put them further behind financially. Any new approach would need to be voluntary, with clear instructions on how families could control their data-sharing preferences or opt out altogether.

The team also wanted to ensure the program was designed around meeting the needs of real families—not pushing a program. To help design a successful program, the team needed to explore motivations and barriers for families, as well as different ways to improve access to tax credits and reduce paperwork. To do that, we engaged directly with families to assess their previous experiences with tax credits and state agencies, as well as their interest in a hypothetical program that simplified filing and involved a limited interagency datashare.

Both the Illinois Department of Revenue and the Illinois Department of Human Services were open to discussing how such a program could be designed to meet families’ needs for easier, less costly tax filing.

The next step was working with families directly to learn what would work for them. The Chicago team partnered with Community Organizing and Family Issues (COFI), an Illinois-based nonprofit with parent leadership groups all over the state, and the New Practice Lab at New America to increase the team’s capacity and tap into additional expertise in design and technical sprints for state agencies.

Partnering with parents to design a better approach to tax credits

Initial interaction with COFI showed the team that simplifying the process for accessing tax credits was something parent leaders had already discussed and were interested in learning more about. In order to explore whether this type of approach would work, we needed to know how parents would react to a program that identified their potential eligibility for tax credits and which services or outreach would be most helpful to them.

The Chicago team attended two COFI meetings to present the concept to parents and hear their feedback. Following those meetings, the Chicago team worked closely with design researchers from New Practice Lab (NPL) to interview COFI and CivicSpace-recruited low-income parents from Chicago and surrounding areas. In October 2024, we hosted a co-design session with COFI parent leaders in East St. Louis, Illinois. The co-design session brought together staff from both state agencies to listen to parent preferences and needs. Parents shared their interest in this type of program and made suggestions for the timing, design, and communications they would like to see.

In early 2025, an NPL design researcher used findings from the meetings and co-design sessions to test potential messaging with a group of 10 parents. The messaging could be used to share basic information about tax credit eligibility, something IDHS is required to do under Illinois state law; help parents find free tax filing help, or participate in a new streamlined tax-filing program should the departments decide to implement one.

Families are eager for a program that helps identify eligibility and reduces cost barriers to state tax credits

Low awareness and cost concerns were persistent among those interviewed. Awareness of tax credits like the Earned Income Tax Credit (EITC) remains low among many families, particularly those who file taxes irregularly or not at all. While the Child Tax Credit (CTC) had more visibility due to media coverage, it was often confused with the EITC. Families were surprised to learn they might qualify even with part-time or gig work, and few knew that the Illinois EITC had expanded to include ITIN filers.

Similarly, many families had negative experiences with paid tax preparers and voiced concerns about hidden fees, emphasizing the need for clear communication that any new program would be free of charge. One participant summed it up: “They know exactly how much they’re gonna take out your taxes, but they don’t know how much you gonna get back.”

Families expressed strong interest in a simplified tax filing program—especially when they understood how their data would be used to their benefit.

The phrase “data sharing” initially raised red flags, but once participants heard that only limited, necessary details would be used (like name, SSN/ITIN, and household size), they were far more open to the idea. Participants felt that multiple government agencies already had access to this information. Therefore, they were less concerned about their information being shared if it helped save their family time and money. “If they send us the [tax return] and we just check it, it can help us simplify…the way we do taxes,” said Elisa, a mother of two from the Chicago suburbs. Having an existing relationship with the Illinois Department of Human Services (IDHS) played a major role in that comfort, and once families understood the role of the Department of Revenue (IDoR), they saw its tax expertise as a valuable part of the solution. As another mother of two, Angela, put it, “I feel a little bit better because I feel like I had an expert help me.”

In the 2024 co-design session, Illinois parents stressed their hope that the state would conduct outreach around any new program that could help them access state tax credits. In simple language, they wanted to be notified that they may be eligible for cash benefits through a free state program. They wanted the state to provide transparency on how the program works — eligibility requirements, the steps they needed to take, and any possible fees or deductions. They felt many families would be eager to file if they knew what they were missing out on.

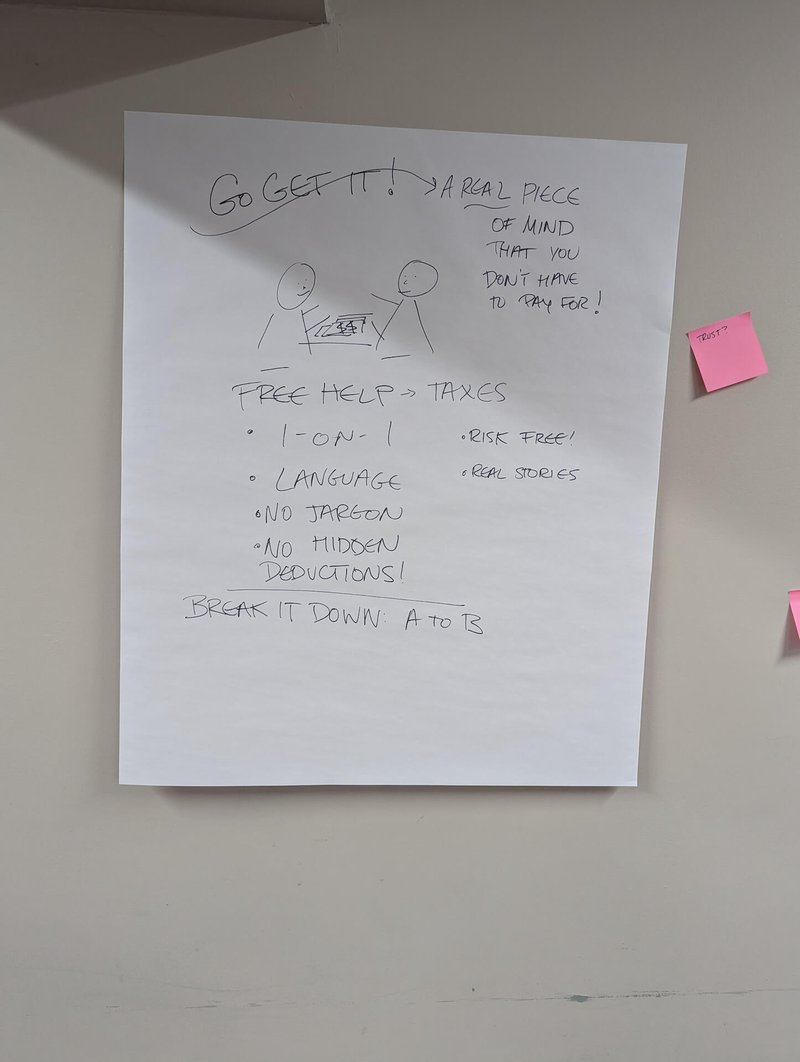

Community members drew up their ideas for how they wanted to be messaged during the 2024 co-design session in East St. Louis, Illinois.

Source: Alejandra Ponce de Leon

Key Elements of a New Program Design

In spite of the variety of challenges families face with filing taxes, there were many common concerns that a new state program could address through a coordinated communication plan.

Families felt the new program should provide: ongoing communications, consistent information presented in friendly language, and a variety of support from simple checklists to guided interfaces. The team developed a draft service plan to illustrate how the two departments could work together based on family feedback.

Ongoing communications through multiple channels

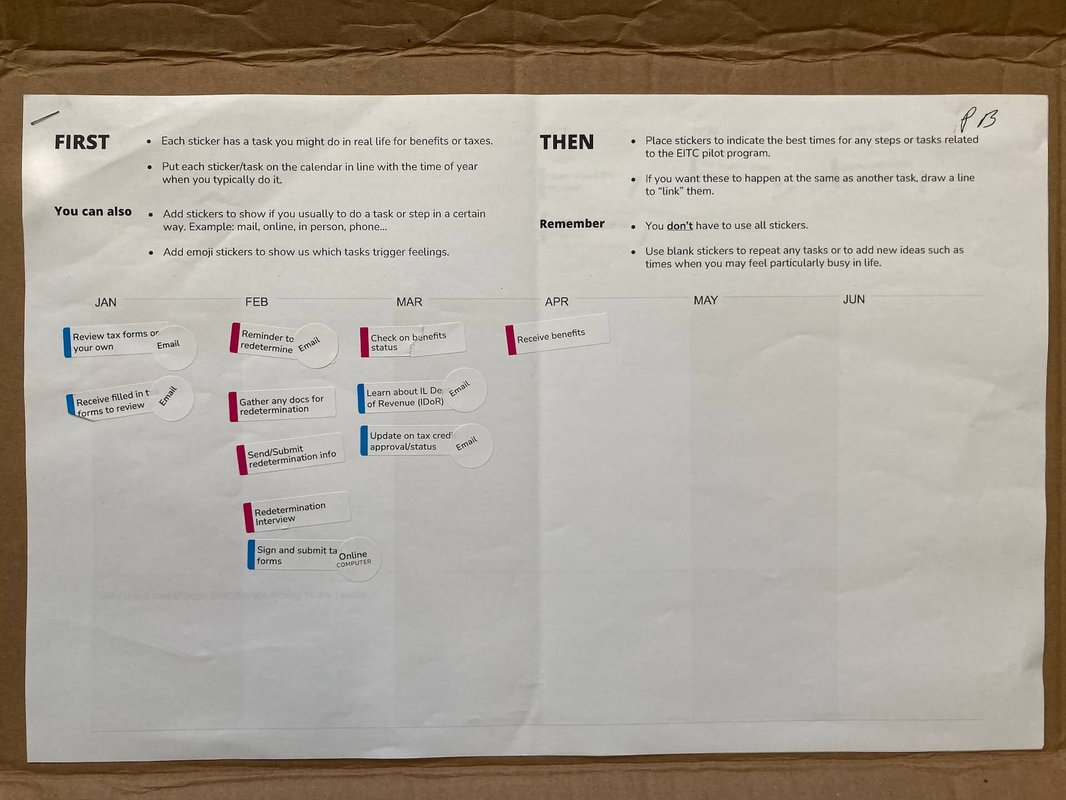

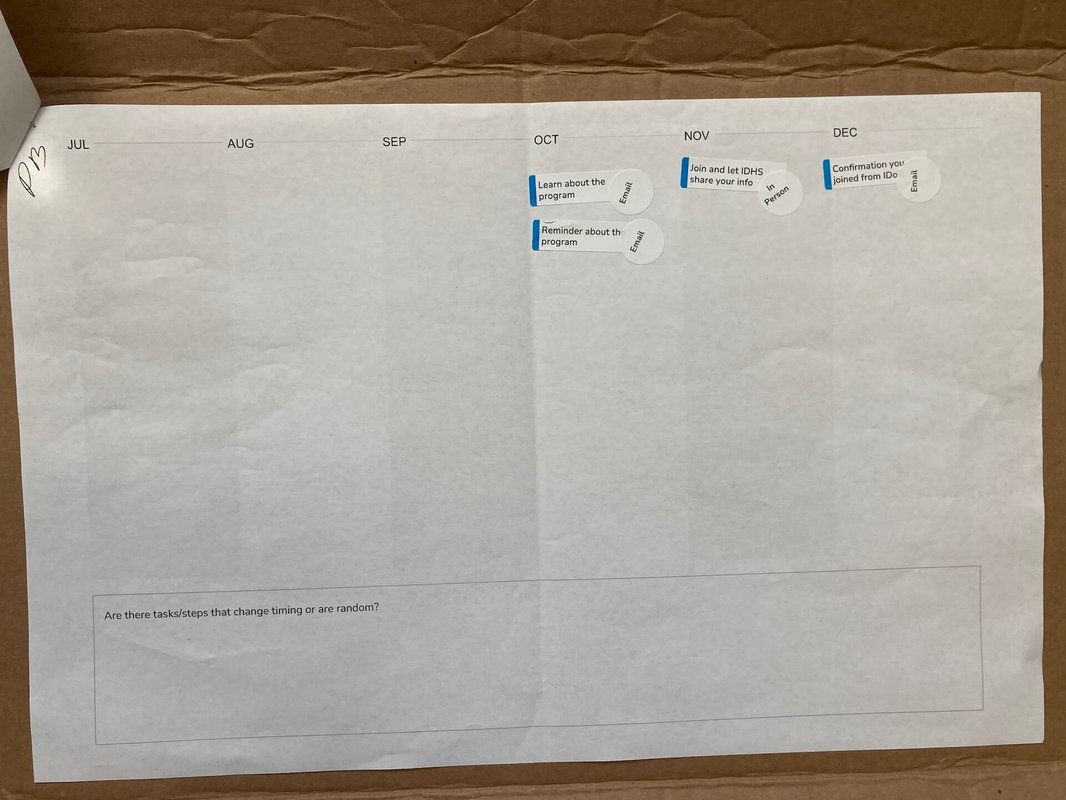

Participants stressed the importance of early outreach—ideally starting in the fall—so families can avoid being overwhelmed by competing offers from tax prep services and high interest tax refund advance companies. Some suggested that receiving this information when they were in the process of applying for benefits might be overwhelming and they may miss steps they should be taking. Receiving information separately on how to file to receive this money was preferred. They recommended using multiple communication channels to improve reach and reliability, especially given frequent issues with delayed or lost mail. Many preferred receiving the same message through text, email, and physical mail to ensure they could act on it. Trusted community touchpoints such as schools, libraries, and doctors’ offices also play a vital role in spreading awareness, especially among more vulnerable families.

Source: Alejandra Ponce de Leon

Example of a participant worksheet demonstrating how families wanted new program outreach to happen way ahead of tax season, ideally in October.

Source: Alejandra Ponce de Leon

Just as important as early and frequent outreach is the need for consistent, event-driven notifications—something families have come to expect in other areas of their lives. Participants wanted updates on their return status, confirmation of submission, and clear next steps. “I don’t know if they can do like Amazon…get text message updates on the progress of it. That’d be pretty cool,” said Mike, a father from Chicago. Simple, timely messages could help families avoid missed deadlines or benefit interruptions.

Messaging that speaks to families, not tax experts

Designing a streamlined tax credit program for families already connected to state services requires tailored outreach. Participants varied in frequency of filing and motivation to do so, meaning that standard language around filing for “tax credits” didn’t always resonate—especially for non-filers. Instead, families responded better to messaging that emphasized the “money they might be missing” and used plain language. A targeted approach using behavioral archetypes proved promising in early testing: eight out of 10 participants selected messages aligned with their motivations.

“They were direct and the right tone. It’s like they are helping me out instead of just giving the message.”—Single parent who pays for online tax filing, describing messages that resonated

Building filer confidence through a spectrum of high to low-tech solutions

The process of completing taxes was high stress for many of the families, because an unintentional error could mean delays on much-needed refunds or even audits. The research found that providing even light interventions and self-serve guidance for individuals helped to boost confidence in completing their taxes.

“I don’t wanna submit something willingly knowing I did it wrong…I didn’t go to school for taxes.”—Angela, mother of two, explaining how overwhelming it can be to complete even simple taxes

Families strongly valued support throughout the filing process, especially in reviewing pre-filled forms. While one-on-one help was ideal for some, many were open to scalable options like guided interfaces, checklists, and FAQs. Even low-touch tools had a big impact: Seven out of 10 testers said a checklist or guided interface would boost their confidence.

Programs that build confidence while offering layered support—from digital tools to human assistance—will go further in ensuring access and usability for the diverse needs of families.

Evolving Program Strategy to Meet a New Policy Landscape

As state agencies navigate myriad federal changes in benefits programs in 2025, Illinois can still leverage fundamental aspects of the program concept: communications and trust in agency expertise.

The team originally planned to work with both the Illinois Department of Human Services (IDHS) and the Illinois Department of Revenue (IDoR) to explore what basic income and family size data could be shared with participant permission. This was because the income and dependents data collected by each department is subject to different time periods and definitions, but could be helpful in alerting participants to their potential eligibility for tax credits and helping them enroll in a program to assist with the tax filing process. However, with major shifts in the federal policy environment, including defunding support for the well-designed IRS Direct File tool, the team was not able to pursue that stage of the process. As a result, the team shifted focus to finding ways to make the process easier and less expensive for parents, without requiring a direct data share between departments. However, it must be noted simply notifying parents that tax credits may be available to them would have a limited impact since it does not remove barriers to filing, so a third new way is needed.

Rather than focus on an inter-agency data share to pre-fill tax returns, we suggest building on families’ trust of agency expertise and shifting the focus to each agency’s existing capabilities:

- Increasing awareness of eligibility for the Illinois EITC through IDHS’s relationships with families; and

- Reducing cost barriers through IDoR technology and tax expertise.

Families did not expect IDHS to help with taxes and they didn’t expect IDoR to help with benefit redetermination. In the new program idea, they perceived IDHS and IDoR’s participation as extra help—simplifying an otherwise difficult process. Families were thankful for anything the departments could do to save them time and stress involved in filling out complicated and confusing forms.

Fortunately, each department already has existing expertise and systems to contribute. Positioning IDHS as community partners and IDoR as the tax experts not only fits the public expectations of each agency’s expertise, but allows each agency to minimize their lift and maximize their impact on successful public participation.

IDHS has the potential to significantly increase EITC awareness and help families engage with the program, without getting involved as tax experts. By using their existing interactions with families, including website, in-office screens, texting, and the application process, IDHS can link families to free tax filing tools and support from IDoR and other tax experts, with limited impact on agency time.

Even without sharing any data, IDHS could point families towards IDoR—who they view as tax experts—to help non-filer families determine whether filing taxes would be worth their time. This would help get valuable information about tax credit eligibility to families IDoR does not have contact with.

This would allow IDoR to focus on leveraging its own tax expertise, providing self-service eligibility tools, pointing participants to trustworthy tax filing tools, and credible program information, such as checklists or FAQs.

Three Models to Expand Uptake of Tax Credits

Illinois and other states have several potential options to reduce paperwork, frustration, and costs to help eligible low-income families claim tax credits they are owed. Providing access to tax credits they are owed could help millions of taxpayers afford increases in the basic cost of living. However, given recent massive federal cuts to a number of social safety net programs and burgeoning concern about safely sharing data in the current federal environment, states like Illinois may struggle to take on new initiatives that would involve new data-sharing agreements and interagency collaboration. Fortunately, there are other ways to accomplish the same goal at different levels of commitment, funding, and staff time, without requiring extensive data sharing. Here are three potential models to consider.

Model 1: Well-timed Information for IDHS clients

Lightest weight (in terms of resources required), some impact

- This model focuses on leveraging IDHS and IDoR communications channels.

- Departments partner together to produce content for social media, text messaging, and an existing EITC letter to IDHS clients.

- Additional general outreach through in-office visual messaging, the IDHS and IDoR websites, and other existing social media and texting channels.

- In October and January through April, IDHS shares information with families about who is likely eligible for the state and federal EITC and CTC, as well as linking to more information on the credits and free filing tools on the IDoR website. Outreach includes in-office visual messaging, the IDHS website, and other existing channels. It could also include sharing the MyFriendBen estimator tool for Illinois.

- In May and June, IDHS reaches out to families who may not realize they can still file for the previous three years’ tax credits to connect them to IDoR resources.

Model 2: Gentle Hand-off, without Data Share

Moderate agency commitment, medium impact

- This model combines existing IDoR and IDHS communications channels more effectively with existing technology.

- Departments partner together on social media, text messaging, and an existing EITC letter to IDHS clients.

- Additional general outreach through in-office visual messaging, the IDHS and IDoR websites, and other existing social media and texting channels.

- For families with dependent children and some earned income, ask in the application or redetermination form if they are interested in free help to claim any tax credits they may be eligible for from the previous three years.

- In October and January through April, IDHS reaches out to families who requested free help and directs them to the MyFriendBen estimator tool or another free estimator on the IDoR website. IDHS also connects them to more information on the credits, checklists, other supports, and free filing tools on the IDoR website.

- In May and June, IDHS reaches out to families who may not realize they can still file for the previous three years’ tax credits to connect them to IDoR resources.

Model 3: Client Opt-in, without data share

Long-term project with supportive federal policy, higher agency commitment, higher impact

- This model combines existing IDoR and IDHS communications channels more effectively with new technology built over time.

- Departments partner together on social media, text messaging, and an existing EITC letter to IDHS clients.

- Collaborate to produce additional general outreach through in-office visual messaging, the IDHS and IDoR websites, and other existing social media and texting channels.

- For families with dependent children and some earned income, ask in the application or redetermination form if they are interested in free help to claim any tax credits they may be eligible for from the previous three years.

- In October and January through April, IDHS and IDoR jointly reach out to families who requested free help and direct them to a simple-to-use free file tool with estimator, such as Code for America’s Get Your Refund, linked on the IDoR website. Outreach includes information on the credits, checklists, supports, and free filing tools on the IDoR website.

- Families can opt in to receive an alert from IDoR each year if they are likely eligible for tax credits based on their W-9s or 1099s.

- If a family does not file that year, IDoR reaches out in May through July with a range of potential tax credit amounts based on their family size and previous year's income to let them know they are still eligible to file for previous years and connect them with free file tools.

- With long-term, future collaboration with the IRS, additional pre-filled or simplified filing options may become available.

Next Steps to Simplify the Process for Families

Access to these tax credits could both improve outcomes for children and lead to reinvestment in local economies, as families use that money to catch up on bills or pay for their children’s essentials. This research suggests that a simplified filing program for the Illinois Earned Income Tax Credit and Child Tax Credit could significantly improve both awareness and access to tax credits for low-income families already receiving state benefits. Additionally, this program would aid families who already file by saving them substantial time and money. Given current federal policy trends, we recommend a simplified program that does not involve a data share between departments.

Successful implementation will depend on the quality and timing of communications from both departments. Targeted messaging, timely reminders, and event-triggered notifications will be essential. While a robust website and intuitive guidance in program materials and products would serve many families well, a strategic approach to supporting families as customers—by balancing scalable solutions for common questions with personalized assistance for more complex cases—would maximize participation in these programs, allowing them to reach as many families as possible.

Over the long term, Illinois lawmakers could consider: (1) funding IDoR and IDHS to collaborate on a pilot to test a more intensive model that involves an opt-in, where families give IDoR permission to access their income records to help ease form completion; (2) clarifying the Illinois statute around notifying clients of eligibility for the EITC by adding a requirement for IDHS to collaborate with IDoR to provide an estimate of both EITC and CTC eligibility to clients and determine a method to simplify the filing process for those clients.