Beyond Outreach: Making Tax Credits Easier to Claim

One of our greatest poverty fighting tools is behind the tax system

Blog Post

Shutterstock

Feb. 6, 2026

The 2026 tax filing season is here, bringing with it a tax code that delivers the most effective anti-poverty initiative for children in the United States: refundable tax credits. Unlike most tax credits, refundable credits are issued as cash refunds when they exceed the amount of taxes owed. Eligible filers who don’t owe taxes receive the full amount of the credit as a refund.

In 2024, the Census Bureau reported that refundable tax credits lifted approximately 6.4 million people out of poverty, and the majority of those people are under eighteen. For the 2025 tax year, a family with three qualifying children could be eligible to receive more than $8,000 through the Earned Income Tax Credit (EITC) and up to $5,100 of refundable Child Tax Credit (CTC).

Federal eligibility requirements for both the EITC and the CTC have recently become more restrictive. Last year’s One Big Beautiful Bill Act (OBBBA) disqualifies children from CTC eligibility when neither parent has a social security number (SSN). As a result, up to 2 million children who previously benefitted from the CTC will not do so this year.

The good news is that many states have expanded access: twenty nine states and the District of Columbia now offer their own refundable credits. The dollar amounts are smaller than their Federal counterparts but are often available to a broader pool of people: nearly half of the twenty nine states allow filers without a Social Security number to receive refundable credits.

Between the federal and state programs, there are significant amounts of money available, but critically, individuals need to file taxes to get it. Year after year, up to 20% of people potentially eligible for the EITC don’t file taxes (often because they don’t make enough to be legally required), or fail to claim the credits on their tax form.

Why people don’t file

In 2025, NPL conducted a comprehensive survey to better understand the underlying issues that result in people not filing taxes. With a sample size of over 5,000 households, mostly from people with lower incomes who file taxes infrequently or not at all, the New Practice Lab released its report Designed for Filing, Not for Families: Reimagining Tax Credit Delivery, in May of last year. The report examined filing barriers individually, diving deeply into awareness, the fear of making mistakes, the cost of filing, and the complexity of the tax code. NPL also examined the survey data with a more holistic lens: when combined into a single list, which filing barriers did respondents cite the most frequently?

As a new filing season kicks off, we’re publishing the list to spotlight what many people in the tax space already know: systemic and practical barriers — more than awareness of tax credits — are the main reasons that people don’t file taxes, even if they stand to receive a refund. The top five challenges reported by survey respondents are all related to the act of filing taxes:

Outreach is not sufficient

Many governments looking to ensure that refundable tax credits reach more people start with outreach campaigns to increase awareness. These campaigns range from ads about tax credits on billboards and bus stops to targeted letters, e-mails, and texts to potentially eligible families. It’s a natural starting place because outreach doesn't require extensive resources or policy changes. Additionally, there is evidence in the field that a thoughtful outreach campaign (especially when data-driven) does have a modest impact on the number of filers who claim credits.

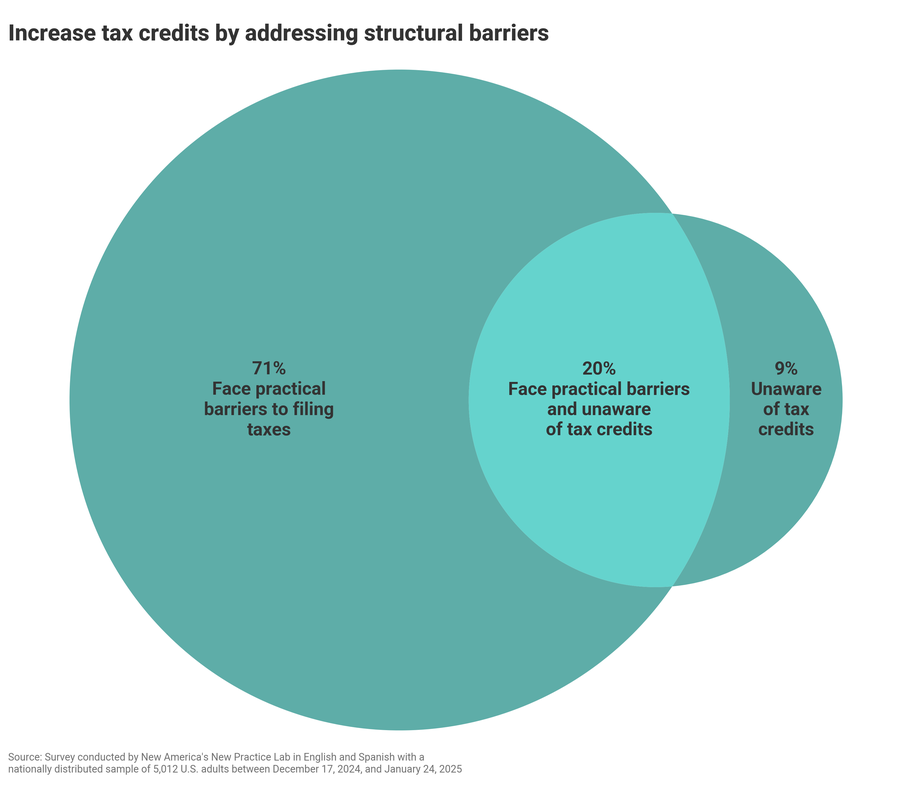

Outreach campaigns generally tackle the "awareness" problem. Of the survey respondents who reported facing one of these barriers to filing, less than 10 percent cited lack of awareness as the only problem:

A Venn diagram that shows a 20% overlap between the 71% of survey respondents who face practical and structure barriers when filing taxes and the 9% who are unaware of tax credits

Source: Becky Sweger / New Practice Lab

Our research — both quantitative and qualitative — shows participation of those that are eligible in tax credit programs will only be possible by addressing practical barriers to filing. Because filing taxes is currently the only way to claim EITC and CTC money, there must be a straightforward, frictionless path to doing it — and our team has begun work with states to find solutions that do this.

Expand the definition of compliance

Within revenue departments, compliance typically refers to finding people and businesses that owe taxes and haven’t paid them. What if governments broadened the scope of compliance to proactively look for people who are owed money?

If state revenue departments expand their own definition of compliance, they can use data and processes to identify individuals who are eligible to receive tax credits and haven’t claimed them, like Colorado has done.

Pre-populate tax forms

Almost half of our survey respondents reported difficulty finding the documentation required for filing, which is why pre-populating tax forms is another important strategy for reducing filing barriers.

Governments can pre-fill tax forms with data they already have, saving individuals time and effort when tracking down their documents. As a bonus, pre-population also helps mitigate two of the other top five filing challenges: the fear of making mistakes and trouble understanding technical tax instructions.

Because states have different relationships to the IRS and different data sharing laws, there’s no one-size-fits-all list of available data sources for pre-population. Some potential avenues include:

- Information already available in the tax system (e.g., prior year returns, federal return data to identify individuals missing out on state credits)

- State benefits programs and integrated eligibility systems

- IRS (via state data sharing or explicit consent provided by filers)

- Payroll companies

Streamline tax credit eligibility and automatic refunds

A natural next step after enhanced compliance and pre-population is shifting the burden of eligibility checks from the individual to the government. Could it be possible for governments to determine who is eligible for tax credits and reduce (or eliminate) the amount of work required to claim them?

It won’t be easy. Data privacy and program integrity are important considerations, but small, tactical pilot projects are valuable tools for understanding what’s possible and adjusting to new processes.

What states can do today

Although refundable tax credits are an important anti-poverty tool, many potential beneficiaries are shut out because too many barriers stand between them and a completed tax return.

As Devyani Singh, the New Practice Lab’s data and strategic impact lead, noted in a recent op-ed, “The decision not to file wasn’t about motivation but rather about complexity, fear, and survival.”

As revenue departments recognize their role in delivering this critical cash, some are going beyond typical outreach methods and addressing these more structural barriers. We must continue exploring meaningful solutions that smooth the filing process like those above to ensure that those entitled to refundable tax credits get them.